(Originally posted on Xendit’s blog)

I’ve been asked a decent amount by friends, other founders and employees about how to think through COVID-19, impacts to our markets, all to make sure we guide our businesses well through these times. I’ve never been through a cycle myself so I lean heavily on studying others and learning from history so we can give ourselves the highest chance of success.

Overall, I think my philosophy during a crises is:

Be Fearful When Others Are Greedy and Greedy When Others Are Fearful

Warren Buffet

Prepare for a recession lasting >2 years

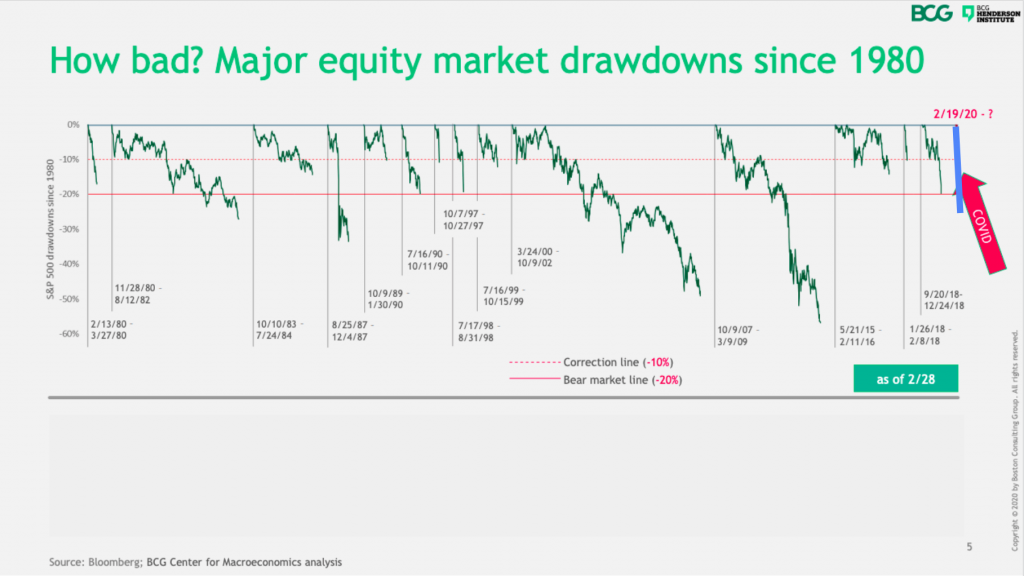

There’s a lot of literature and countless opinions upon whether this is a V, U, W style comeback. I like this piece of data by BCG showing recessions since 1980. We can expect that this recession could last 1.5-2 years until the markets start to rebound (as in 2000 or 2007). Let’s hope this isn’t the Great Depression which lasted about 10 years and only really changed because war drove massive demand for products and services.

What you will notice about these graphs is there are always false hopes (bear market rallies) where politicians announce things that temporarily relieve the strain on the market. So don’t take action on announcements, but wait for real changes in the economy to get your hopes up.

One other interesting record is that COVID-19 caused the fastest drop of the S&P 500 into bear market territory. It says something about the severity and decisiveness of COVID-19’s impact on the economy.

For those new to recessions, the script could look like:

- Virus causes supply shocks due to shutdown in China, this means no iphone parts for Apple

- Lockdowns now mean we don’t go to restaurants/gyms etc and demand drops

- Demand drops means businesses go bankrupt and fire/furlough/paycut workers

- Bankrupt businesses and fired workers don’t pay back debts, spend less

- NPLs climb, banks and lenders don’t lend, so you have credit crunch (like 2008)

- These recessionary impacts typically take 1.5-2 years (based on the last 30 years) to reach the bottom and then markets slowly recover. It will take longer if governments don’t intervene

Overall macro environment shrinks

- Drop in business activity – lots of businesses are missing/revising targets, e.g. Apple, Microsoft

- Supply chain disruptions – this is different from other recessionary triggers because for global markets, this started out as a supply disruption vs demand. It’s now quickly turned into demand too

- Travel slows – Asia is down 98% in travel (see chart below). US expecting $113b impact on US airline industry

VC financings could slow/stop

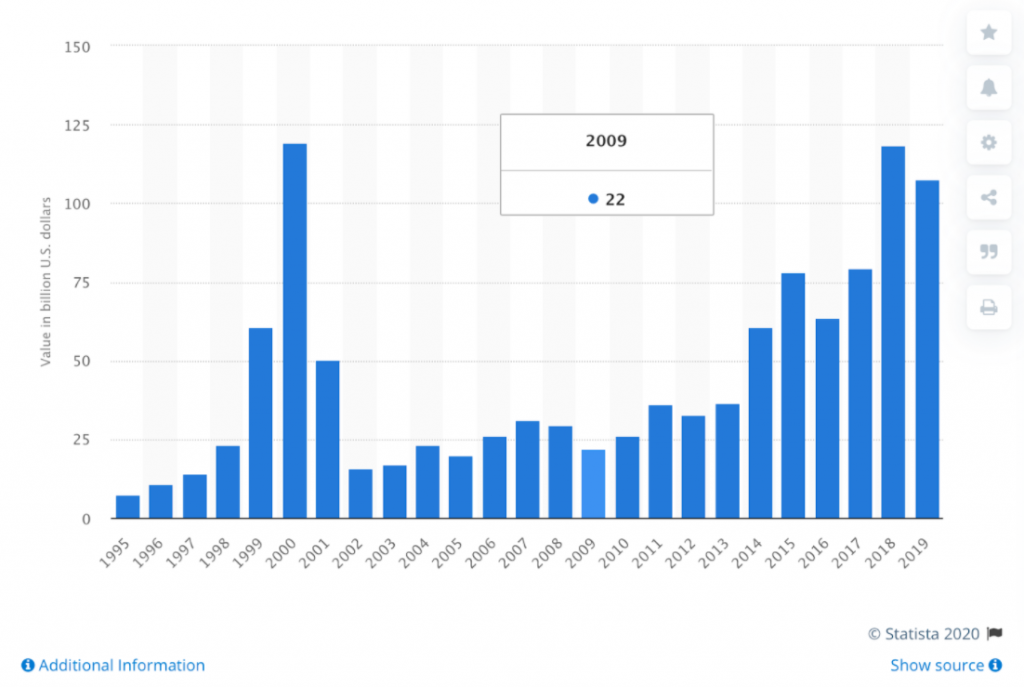

I’m calling out this one because this one change has massive impacts on the startup landscape. The last two times we saw recessions, VC financings fell: 87% drop in financings from 2000-2002; 30% drop from 2007-2009. The difference this time is there is a tonne of “dry powder”(means cash not yet invested) sitting on the sidelines which may change how this one impacts the world. This means VCs have money to invest in good deals (relieving funding gap a little) and historically means VCs with deep pockets double down into existing investments that may need bridge financing.

There is a really rare opportunity to win

Keen to keep reading? Head over to the original post on Xendit’s blog “A roadmap for COVID-19”.

In that article I relay advice from other startups (that have thrived during recessions) and investors (that have been through crises before).